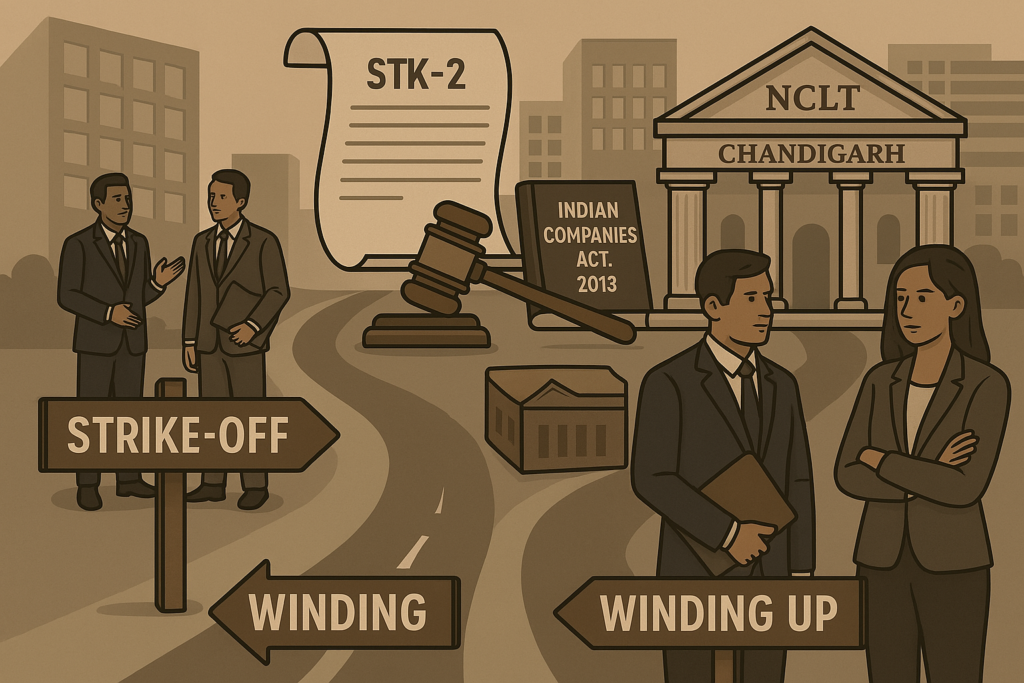

Understanding the legal process for company strike-off vs. winding up in India is crucial for business owners, legal practitioners, and students of corporate law. Whether you’re planning to close a dormant company or dissolve a financially distressed business, the legal route you choose has implications for compliance, liabilities, and future operations. This article explains the key differences, legal procedures, and statutory requirements under the Companies Act, 2013, and other relevant laws. It will help you assess which process Company Strike-Off vs. Winding Up in India is appropriate, especially if you’re seeking guidance from corporate lawyers in Chandigarh or high court advocates in Chandigarh.

Understanding Company Closure in India

Types of Company Closure

Companies in India may legally cease operations through:

- Strike-Off (also known as “Removal of Name from Register”)

- Winding Up (voluntary or by tribunal)

Each method is governed by different sections of the Companies Act, 2013 and is suited for different business circumstances.

Company Strike-Off Under Companies Act, 2013

The strike-off procedure allows companies to voluntarily remove their name from the register of companies maintained by the Registrar of Companies (ROC). It is ideal for dormant, non-operational, or inactive companies.

Governing Law and Sections

- Section 248 of the Companies Act, 2013

- Rule 4 to 9 of the Companies (Removal of Name of Companies from the Register) Rules, 2016

Eligibility Criteria for Strike-Off

Companies can apply for strike-off if:

- They have not commenced business within one year of incorporation

- They have not carried out any business for two consecutive years and have not filed an application for dormant status

- They have no liabilities or pending litigation

Application Process for Strike-Off

Step 1: Board Resolution

Pass a board resolution approving the strike-off application.

Step 2: Special Resolution or Consent

Hold a general meeting and pass a special resolution or obtain consent from 75% of shareholders (in case of a private company).

Step 3: Filing Form STK-2

File Form STK-2 with the ROC, along with:

- Indemnity bond (Form STK-3)

- Affidavit by directors (Form STK-4)

- Statement of accounts (certified by a Chartered Accountant)

- Board and special resolutions

Step 4: Public Notice by ROC

ROC issues a public notice and invites objections within 30 days.

Step 5: Final Strike-Off Order

After verifying documents and objections (if any), the ROC issues a notice of strike-off and publishes it in the Official Gazette.

Winding Up of a Company in India

Winding up is a formal liquidation process that involves settling the company’s debts, selling assets, and dissolving the entity. It is used when a company is insolvent, or when the shareholders choose to close a functioning business.

Types of Winding Up

- Voluntary Winding Up (under Section 304 – now removed for most cases after the IBC)

- Compulsory Winding Up by Tribunal (under Section 271 of the Companies Act, 2013)

In most cases today, insolvency-based winding up is routed through the Insolvency and Bankruptcy Code, 2016 (IBC).

Winding Up by Tribunal: Legal Provisions

Section 271 – Grounds for Compulsory Winding Up

A company may be wound up by the National Company Law Tribunal (NCLT) if:

- The company is unable to pay its debts

- The company has acted against the interest of sovereignty and integrity of India

- The company has defaulted in filing financial statements for five consecutive years

- The Tribunal believes that it is just and equitable to wind up the company

Who Can File the Petition?

- The company itself

- Creditors

- Shareholders

- The Registrar

- The Central Government

Procedure for Winding Up by Tribunal

Step 1: Filing of Petition

File a winding up petition before the NCLT with jurisdiction. In Chandigarh, this is usually filed before the NCLT Bench in Chandigarh through corporate advocates in Chandigarh.

Step 2: Appointment of Liquidator

If the petition is admitted, the Tribunal appoints a Company Liquidator to manage the affairs.

Step 3: Statement of Affairs

The company must submit a Statement of Affairs to the liquidator within 30 days of the order.

Step 4: Liquidation Proceedings

The liquidator:

- Takes over company assets

- Pays creditors

- Prepares a final report

Step 5: Dissolution

The Tribunal passes a dissolution order, and the company ceases to exist as a legal entity.

Strike-Off vs. Winding Up: Key Differences

| Criteria | Strike-Off | Winding Up |

| Governing Section | Section 248 of Companies Act, 2013 | Section 271 of Companies Act, 2013 |

| Authority | Registrar of Companies (ROC) | National Company Law Tribunal (NCLT) |

| Purpose | To close inactive or dormant companies | To liquidate insolvent or operational firms |

| Duration | 3–6 months | 6–12 months or longer |

| Complexity | Simple, document-based process | Formal, court-driven process |

| Cost | Lower legal and professional fees | Higher due to litigation and liquidation |

| Suitable For | No assets or liabilities | Debt-ridden or disputed companies |

Compliance After Company Closure

Even after the closure of the company, the promoters/directors must ensure:

- All statutory dues are cleared

- Tax filings are completed

- No pending litigation or dues to employees

High court lawyers in Chandigarh often assist clients in handling post-closure compliance, especially in cases involving regulatory scrutiny.

Legal Risks of Improper Closure

- Revival under Section 252 of Companies Act: If strike-off was fraudulent or misleading, stakeholders may file a revival petition

- Director Disqualification: Under Section 164(2), directors of defaulting companies may be disqualified

- Regulatory Penalties: Non-compliance with closure procedures can lead to penalties by MCA, SEBI, or Tax Departments

Jurisdiction for Filing: Chandigarh

- Strike-off applications are filed with Registrar of Companies, Chandigarh

- Winding up petitions are filed with the NCLT Bench in Chandigarh

- Appeals and constitutional matters are handled in the Punjab and Haryana High Court with the help of high court lawyers in Chandigarh

Choosing between strike-off and winding up depends on the company’s financial status, liabilities, and future plans. While strike-off is ideal for inactive companies, winding up is necessary for those with debts or disputes.

Understanding the statutory framework under the Companies Act, 2013, Rules of ROC, and the IBC is vital. Filing the correct process through corporate lawyers in Chandigarh or high court advocates in Chandigarh ensures compliance, risk mitigation, and a smooth legal closure.

FAQs on Company Strike-Off vs. Winding Up in Chandigarh

1. Which is faster: strike-off or winding up?

Strike-off is typically faster, taking 3–6 months, while winding up is more time-consuming due to the formal judicial process. Consult experienced corporate lawyers in Chandigarh to assess timelines.

2. Can a company with debts apply for strike-off?

No, companies with outstanding liabilities or ongoing litigation are not eligible for strike-off. In such cases, winding up under Section 271 or IBC is the appropriate route. Seek advice from advocates in Chandigarh or NCLT lawyers.

3. What is the role of NCLT in winding up?

The National Company Law Tribunal (NCLT) adjudicates winding-up petitions, appoints liquidators, and passes dissolution orders. For cases in North India, petitions are filed at the NCLT Bench in Chandigarh.

4. Can ROC reject my strike-off application?

Yes, the Registrar of Companies can reject applications if documentation is incomplete, if there are unpaid dues, or if objections are raised. It’s best to file through reliable corporate advocates in Chandigarh.

5. Can a company be revived after strike-off?

Yes, under Section 252 of the Companies Act, an aggrieved party can file for revival of the company within 3 years of strike-off. This is often handled by high court advocates in Chandigarh in the NCLT or High Court.