Mutation vs. Registration of Property in Chandigarh is a key topic in real estate law, especially for buyers and sellers navigating local procedures. Understanding the legal distinctions, processes, and statutory provisions is essential for property lawyers, advocates, high court lawyers, and property advocates involved in real estate transactions in Chandigarh.

Introduction: Understanding Mutation and Registration

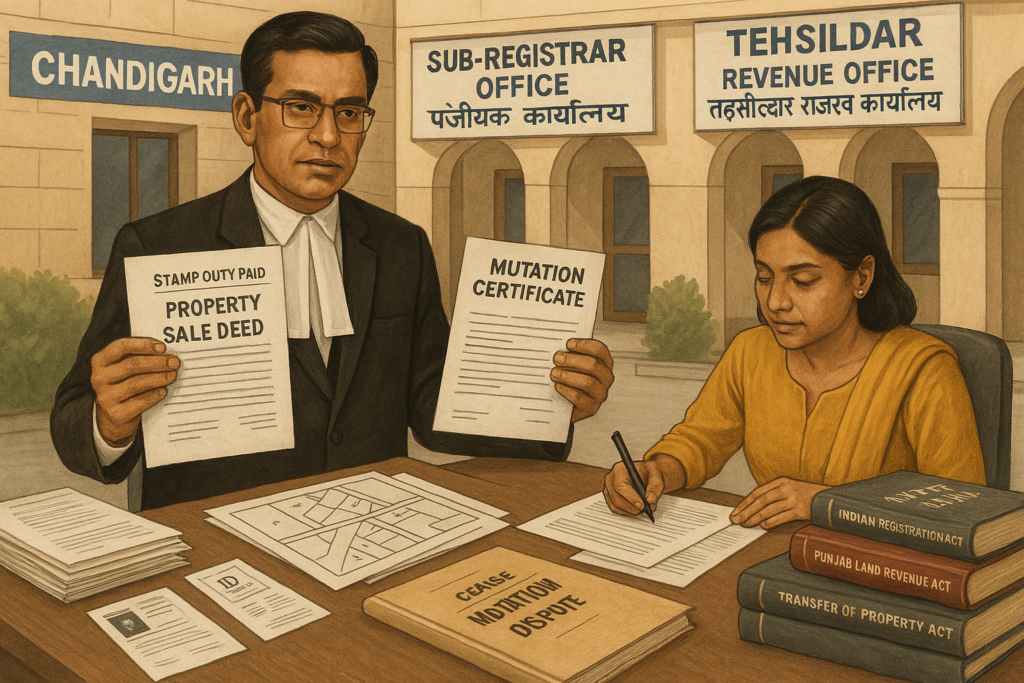

The processes of mutation and registration may seem similar, but serve fundamentally different legal purposes. Registration, governed by the Indian Registration Act, 1908, provides conclusive legal evidence of title and is mandatory in Chandigarh. Mutation, under the Punjab Land Revenue Act, 1887 and related state rules, updates ownership records for revenue and taxation. This section will outline the legal framework and practical importance of each concept in Chandigarh.

Legal Framework and Key Statutes

Indian Registration Act, 1908

Section 17 (Documents of which registration is compulsory)

Section 18 (Documents of which registration is optional)

Section 23 (Non–admissibility of documents of which registration is compulsory)

Sections 70–73 (Effects of registration; non–registration)

This Act governs mandatory registration of sale deeds, gift deeds, exchange deeds, etc., in Chandigarh.

Punjab Land Revenue Act, 1887 (as applicable in Union Territory)

Section 93 (Entry of mutation)

Section 100 (Effect of refusal to consent to mutation)

Mutation is the record of title in revenue records maintained by the Tehsildar or Sub‑Divisional Magistrate in Chandigarh.

Punjab Tenancy Act and Rules

Provisions relating to updates in rights of tenants and landlords, where mutation is necessary to reflect change in occupancy.

Transfer of Property Act, 1882

Section 5 (Concept of transfer of property)

Sections 54, 58A (Sale, lease, and their effect on title)

Transfers under these sections require registration, while mutation reflects their effect for revenue purposes.

State government circulars and notification (Chandigarh Deputy Commissioner)

Guidelines for mutation and registration procedures, including timelines for issuance of Mutation Certificate, and registration fees.

Difference Between Mutation and Registration

Purpose and Legal Consequences

Registration – Legal Title

- Registration creates an irrefutable presumption of title under Section 35 of the Registration Act.

- Document is admissible in court and enforceable, subject to stamp duty provisions of the Indian Stamp Act, 1899.

Mutation – Revenue Record

- Mutation reflects change in ownership in revenue records maintained at the land records office.

- Important for paying property tax, maintaining tenancy records, and facilitating future transfers.

Mandatory Nature

Registration is Mandatory

- Sale deeds, lease agreements over 1 year in Chandigarh; default results in inadmissibility of document and penalties.

Mutation is Subject to Owner’s Application

- Mutation happens upon purchase, inheritance, gift, court decree; refusal can be challenged under Punjab Land Revenue rules.

Procedures and Authorities

Registration – Registrar Office

- Buyers submit deed, Khasra/Gat number, ID proof, PAN, revenue stamps, and registration fees to Sub‑Registrar office in Chandigarh.

- Registrar verifies the identity of parties, legal descriptions, and stamp duty compliance.

- Post registration, a registered document number is issued.

Mutation – Revenue Department

- Application by owner or advocate to the Tehsildar/Sub‑Divisional Magistrate, along with registered deed, property plan, and possession proof.

- Verification by patwari, with objections invited and formal mutation entry in jamabandi (Chandi records).

Timeframes

Registration

- Usually completed within 7–15 days, depending on stamp duty clearance.

Mutation

- Can take 30–60 days or more; objections can delay the process.

Effect of Non‑Compliance

Without Registration

- Transferee has no legal title; document inadmissible in evidence; stay on sale or encumbrance registration.

Without Mutation

- Revenue record remains in the name of previous owner; new owner cannot pay property taxes nor receive RERA compliance benefits properly.

Detailed Steps and Practical Tips

How to Register Property in Chandigarh

- Draft and execute the sale deed on non‑judicial stamp paper (Section 3 of Stamp Act).

- Stamp duty & registration fees as per Chandigarh complex schedule (approx. 6–7% for resale, concessional for women purchasers).

- Visit Sub‑Registrar with parties, witnesses, documents, PAN, photos, ID, property flatt plan, and occupancy certificate (if applicable).

- Registrar’s staff verifies the property and parties; deed is registered physically and digitally.

- Collect certified copy; apply for certified copy by month’s end for mutation and mortgage.

How to Get Mutation Done in Chandigarh

- Post‑registration, prepare mutation application form (“Form D” under PLRA Rules).

- Submit to Tehsildar revenue office with supporting documents: registered copy of deed, property allotment letter (for government plots), Khasra extract.

- Patwari inspects property, may invite neighbors for objection (7–14 days).

- If no objection, Tehsildar enters mutation in jamabandi, issues Mutation Certificate.

- Mutation entails updating revenue records including for property tax and public utilities.

Case Laws and Judicial Pronouncements

Rajiv Ranjan Singh v. State of Bihar, (1995) SCC 386

Emphasized that mutation is “no title‑conferring action” but necessary for revenue records.

Ram Kale v. Kalavati, AIR 1979 SC 931

Mutation cannot be deemed as title; Registration Act supremacy upheld.

Ramnarayan Singh v. Tehsildar, AIR 2005 SC 435

Tehsildar’s refusal to mutate without good cause may be challenged under Article 226 of the Constitution.

Why Both are Essential—and Often Confused

Interplay in Real Estate Transaction

- Registration secures your title under law; mutation ensures your right to pay tax and transfer future.

Common Myths

- Myth: “Mutation is legally sufficient”—False. Mutation doesn’t transfer title; only registration does.

- Myth: “If I fail in mutation, registration will correct it”—False. Mutation is separate and necessary, or leads to revenue and practical issues.

Professional Role of Property Lawyers in Chandigarh

Title Due Diligence

- Property advocates verify chain-of-title, building occupancy certificate, mutation history, encumbrance certificate (EC).

Assistance in Drafting & Registration

- Drafting sale deed, lease agreement, general power of attorney (GPA)—ensuring accuracy in property boundaries, rights, revenue record references.

Resolving Mutation Disputes

- Represent clients before revenue courts (under Punjab Land Revenue Act), or file Writ Petitions in Punjab and Haryana High Court for mutation refusals.

Advising on Stamp Duty Optimization and RERA Compliance

- High court advocates in Chandigarh may advise on concessional stamp duty, capital gains implications, proper disclosure to comply with RERA (for apartments and plotted development).

A clear understanding of mutation vs. registration is paramount for property buyers, sellers, and legal professionals in Chandigarh. The Indian Registration Act, Punjab Land Revenue Act, and related statutes establish a dual‑track system:

- Registration grants conclusive legal title—key for avoidable disputes and valid proof in courts.

- Mutation aligns ownership in revenue records, enabling tax compliance and municipal functioning.

Both are mandatory and complementary steps in real estate transactions. Proper compliance ensures legally enforceable ownership rights and smooth future transfers. Property lawyers, advocates, and high court lawyers in Chandigarh play a crucial role by guiding clients through due diligence, documentation, disputes, and statutory compliance.

By demystifying these processes and legal provisions—such as Sections 17, 18, 35 of the Registration Act, Sections 93–100 of the Punjab Land Revenue Act—students, clients, and legal professionals gain clarity on obligations, rights, and remedies related to mutation and registration.

FAQ on Mutation vs. Registration of Property in Chandigarh

Q1. Is mutation equivalent to registration?

A: No. Registration under the Registration Act (Sections 17, 18) confers legal title. Mutation under the Punjab Land Revenue Act only updates ownership in revenue records. Mutation alone cannot transfer legal title.

Q2. Can a property be registered but not mutated? What impact?

A: Yes, registration may occur without mutation. The title is legally valid, but without mutation the owner may not be able to pay property tax, obtain utility connections, or avail benefits under RERA.

Q3. What happens if mutation is denied?

A: You can file an appeal under Section 100 of the Punjab Land Revenue Act or file a writ petition under Article 226 in the High Court.

Q4. Do NRIs need mutation and registration?

A: Yes. NRIs must register property (per Registration Act) and then apply for mutation to update revenue records and pay taxes. A General Power of Attorney may be used in Chandigarh.

Q5. What costs and timeline are involved?

A: Registration typically requires 7‑15 days; stamp duty (approx. 6%) and registration fees. Mutation may take 30‑60 days depending on verification and objections; Tehsildar issues Mutation Certificate once complete.